What is NPS (National Pension Scheme)?

NPS (National Pension Scheme) is a retirement savings account. It was launched by Indian Government in 2004 for all government employees (except armed forces). It covered all citizens of India after 5 years in 2009. Anyone, who is age between 18 to 65 years can open NPS account.

Government of India launched the Swavalamban Scheme in FY 2010-11, which is called NPS lite. This scheme is available for unorganized sector people to save money for their retirement. It is for the low-income group. The government launched Atal Pension Yojana in 2015.

Benefits of NPS

Tax benefits: NPS allows total tax deduction of rupees 2 lakhs under section 80CCD(1) and 80CCD(1B).

Section 80CCD(1B) covers additional self-contribution towards NPS (up to rupees 50000).

Section 80CCD(2) covers employers contribution or government contribution towards employees NPS account. This section does not have any monetary limit.

Equity Exposure: NPS is a portfolio of equity and debt. Equity part gives growth and debt part gives income and stability in the portfolio.

Low-cost investment: NPS is a very low-cost retirement product in the world. However, there are other charges levied in NPS. Visit NPS website to get updated charges in your NPS account.

Exit at age 60: When you retire at age 60 or when you exit from NPS at age 60. You can withdraw tax-free lump sum amount up to 60% of your corpus and remaining 40% you have to purchase an annuity plan from an insurance company.

Frequently Asked Questions (FAQs)

Question 1: Who can join in NPS?

Answer: Anyone age between 18 to 65 years can start investing in NPS account.

1. Central Government Workers

2. State Government Workers

3. Corporate

4. Individual-Resident as well as Non-Resident Indians (NRIs)

5. Unorganized Sector Workers – Atal Pension Yojana

Question 2: What are the investment Choices Available?

Answer: There are two investment choices available to NPS subscribers.

1. Active Choice: Individual Funds

You have the option to decide how your NPS contributions are to be invested in four asset classes

a. Asset class E – Equity and related instruments (Max allocation 75% till age 50 and thereafter reduces 2.5% a subsequent year till age 60)

b. Asset class C – Corporate debt and related instruments

c. Asset class G – Government Bonds and related instruments

d. Asset Class A – Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc. (Max allocation 5%)

2. Auto Choice: Lifecycle Fund

NPS subscribers who do not have knowledge about any asset class opt for auto choice. It has 3 life cycle funds.

Question 3: How many types of NPS account?

Answer: When you invest in NPS, you become NPS subscriber and you will be allotted Permanent Retirement Account Number (PRAN). Under PRAN you have two types of account.

Tier I: It is a non-withdrawable account, the minimum contribution is Rs. 1000 in a year. you will get tax benefits under Tier I account.

Tier II: It is a voluntary withdrawable savings account. you can deposit and withdraw amount similar to mutual funds.

You cannot have a Tier II account without a Tier I account. Government employees get section 80C exemption if the contribution is locked in for 3 years.

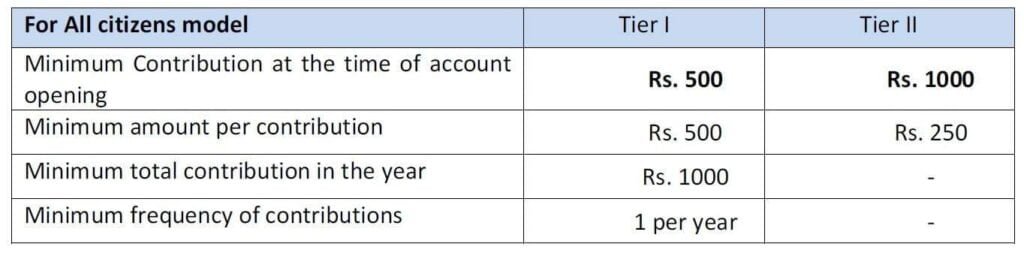

Question 4: What is the Minimum contribution to NPS account (Tier I and Tier II)?

Answer: Your first contribution should be at least Rs 500 for account opening. thereafter you can contribute minimum Rs 500 in a year. Your minimum annual contribution of Rs 1000/- for Tier I account. Minimum contribution for NPS tier 1 and tier 2 accounts.

Question 5: Can an individual have more than one NPS account?

Answer: An individual cannot have more than one NPS account.

Question 6: I am investing in Employees provident fund; can I still have an NPS account?

Answer: Anyone who has EPF or GPF can invest in NPS and get extra tax benefits of 50000 rupees.

Question 7: Can I change or switch investment choice or pension fund manager?

Answer: Yes, Investment choice (Auto or Active) can be switched and Pension fund manager (PFM) can also be switched later.

Question 8: How to open NPS-National Pension Scheme account?

Answer: There are two ways you can start your retirement savings account. First through Point of Presence – Service Providers (POP-SP), second through online by visiting eNPS website.

CLICK HERE to open NPS account online.

If you are confused whether to open NPS account, talk to a financial advisor. Get expert financial advice.

Retirement Benefits for Government as well as private sector employees.

There are other retirement benefits like Gratuity, Leave Encashment and others. Do you want to calculate your gratuity amount?