Table of Contents

- Gratuity Calculator 2023 – How to Calculate Gratuity?

- Best Gratuity Calculator Online 2023

- Gratuity Calculation 2023 in Excel

- Calculate Gratuity in 4 easy steps with a gratuity calculator online

- Gratuity Calculator India

- What is Gratuity?

- What is the Purpose?

- Gratuity Calculation Formula

- Tax-free and Taxable Gratuity amount

Gratuity Calculator 2023 – How to Calculate Gratuity?

In order to calculate gratuity amount at the time of retirement or resignation, Gratuity calculator helps to calculate payable gratuity for all employees working in public, private and government sectors. Let us get started how to calculate your gratuity amount.

Best Gratuity Calculator Online 2023

Gratuity Calculator online is a tool which helps an employee to know how much of gratuity amount they will earn once they retire or resign. How much gratuity you will receive after five years of services? Let’s get started.

[CP_CALCULATED_FIELDS id=”7″ ]Gratuity Calculation 2023 in Excel

You can do gratuity calculations in excel or office spreadsheet.

This excel-based calculator helps to give a payable gratuity at the time of retirement or resignation. If you find gratuity calculator in excel useful. Please share it with others.

The gratuity calculator online works well when you are not comfortable using gratuity calculation in excel. Many people find it easy gratuity calculation in excel.

Read: Personal Finance Best Books to read in 2023 for beginners also

Calculate Gratuity in 4 easy steps with gratuity calculator online

Follow below steps to find out your gratuity amount online.

Step 1: First Enter Your Last Drawn Basic Salary Amount (Monthly)

Enter your basic salary amount per month which was drawn last. if your salary has been increased, you need to enter new basic salary amount.

Don’t enter entire salary amount. Generally basic is always less because if it is high then employer or government will have more gratuity liability.

Step 2: Second Enter Dearness Allowance (Monthly)

This allowance is applicable to central government employees and public sector employees. Private sector employees don’t get dearness allowance.

Enter monthly DA (Dearness Allowance) amount. Leave it blank if not applicable to your situation

Step 3: Third Enter Commission amount received based on fixed % of turnover (Monthly)

Any employees who gets commission based on fixed percentage of turnover or revenue, then enter monthly amount. You should not add monthly incentive

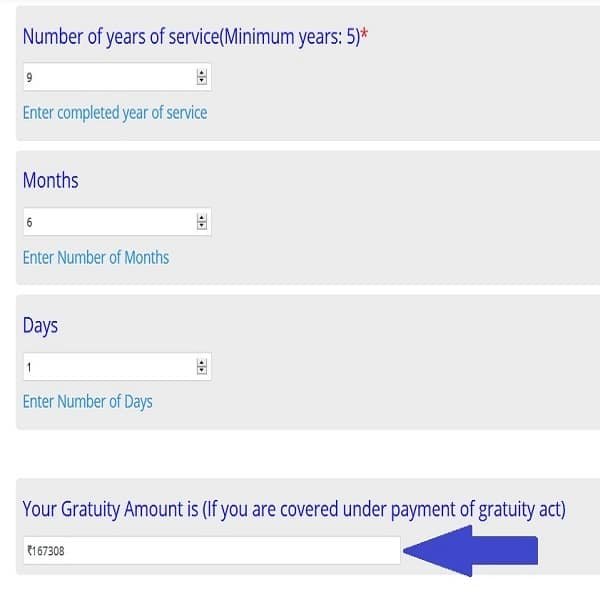

Step 4: Fourth Enter Completed year of service (minimum is 5 years), Months and Day

Calculate your completed years of service, months and days. After that, it will show you gratuity amount. You can reset it to show new figures.

Example- If Ram’s date of joining was 20-Aug-2009 and last working day was 21-Feb-2019. Hence, total years of service is 9 years, number of months is 6, Day is 1. In this case, you will receive gratuity for 10 years.

Gratuity Calculator India

Our gratuity calculator online is applicable for private sector employees working in India. Gratuity calculator India will help all Indian workers to know their gratuity when they retire or resign.

Gratuity Calculator India considers private sector employees covered under payment of gratuity act.

What is Gratuity?

Gratuity is a perquisite amount to be given by employer to all employees except apprentice irrespective of their salary.

It is payable at the time of retirement, resignation to all employees, who has completed at least 5 years of continuous service.

What is the Purpose?

The main purpose of Payment of Gratuity Act is to provide social security to employees or workers after retirement, resignation or disability.

Payment of Gratuity Act, 1972 was amended on 29th March 2018. Therefore, limit of gratuity amount increased from Rs 10 Lakhs to Rs 20 Lakhs.

Gratuity Calculation Formula

If you want to calculate gratuity amount in using normal calculator or phone calculator, then you must know gratuity calculation formula. There are two gratuity calculation formula. First is for people who are covered under payment of gratuity act. Second is for people who are not covered under payment of gratuity act.

Gratuity calculation formula for those who are covered: 15/26 x Last Drawn Wages x Number of completed years of service or in part thereof exceeding 6 months

Gratuity calculation formula for those who are not covered: 15/30 x Last Drawn Wages x Number of completed years of service or in part thereof exceeding 6 months

Government employees get tax free gratuity. However, non-government employees may receive tax free and taxable gratuity.

It is better to use gratuity calculator to determine the value of gratuity to be received.

Do you need any help in your investments, financial planning. You can email us or comment below.

Tax-free and Taxable Gratuity amount

If you want to know how much gratuity amount is tax-free and taxable, then download gratuity calculation in excel

There are so many gratuity calculators online. Therefore, I would recommend to use gratuity calculator in income tax website.

It will help you to calculate gratuity based on different types of employees. If you face any difficulty using gratuity calculators online. please send us a message. we will assist you.

Why is Gratuity paid to employees?

It is a “Gratuitous Payment” or a “Parting Gift”, given to an employee in recognition of his services, when he/she retires or leaves service.

It started as a symbol of goodwill, a voluntary gesture or an acknowledgement of satisfaction on the part of a prosperous employer towards his employees when they part with him after rendering long and faithful service.

Historical Background of Gratuity

Gratuity was always optional for Employer and this led to various disputes with Workmen. In a landmark judgment, the Supreme Court held that Gratuity is a legitimate demand, (Case Ref. Indian Hume Pipe Co. Ltd. Vs. its workmen). By virtue of this decision, gratuity came to be considered as a rightful benefit and no longer a gratuitous payment, as in the past.

Payment of Gratuity Act, 1972

Section 4 (1) – Gratuity shall be payable to an employee after he has rendered continuous service for not less than 5 years,

- On his superannuation, or

- On his retirement or resignation, or

- On his death or disablement due to accident or disease

Section 4 (1)

- Provides that the completion of continuous service of 5 years shall not be necessary where the termination of the employment is due to death or disablement.

- Payment of Gratuity Act, 1972Section 1 (2) – states that the Act, extends to : The whole of India

- But in the State of Jammu & Kashmir, not applicable to plantations and ports.

Application of the Act

Section 1 (3) – Gratuity Act, 1972, shall apply to :

- Every factory, mine, oilfield, plantation, port and railway company;

- Every shop or establishment, as specified by the law, in which 10 or more persons are or were employed, on any day of the preceding 12 months;

- Any other establishments, as the Central Govt. may notify in this behalf, with 10 or more employees on any day of the preceding 12 months.

Once Covered, Always Covered

Section 1 (3A):

- A shop or establishment to which this Act has become applicable shall continue to be governed by this Act –

Notwithstanding that the number of persons employed therein at any time falls below 10.

So, once covered, always covered.

Exemption

- The appropriate government is empowered to exempt by notification any establishment, etc. where the employees of such establishment, etc. are in receipt of gratuity or pension benefits not less favorable than the benefits conferred under this Act.

- The appropriate government may also exempt any employee or class of employees, similarly.

“Employee”

Section 2 (e) :

- “Employee” means any person other than an apprentice.

- Employed on wages, to do any type of work (skilled, semi-skilled, or unskilled, manual, supervisory, technical or clerical work), whether the terms of such employment are expressed or implied and whether or not such person is employed in a managerial or administrative capacity,

“Employee – not included”

Section 2 (e) : Exclusion:

- A person holding a post in Central or a State Govt. and is governed by any other Act or by any other rules providing for payment of gratuity being followed by their respective organization.

Important

5 years service not necessary in case of Death or disablement.

Gratuity payable to nominee or legal heirs of the deceased employee. Minor nominee or legal heirs share shall be deposited with the controlling authority who shall invest the same for the benefit of such minor in such bank or other financial institution, as may be prescribed, until such minor attains majority.

Meaning of Service as per Act

Section 2 (b):

“Completed year of service” means continuous service for one year.

Service –

Section 2A Clause (1):

- An employee shall be said to be in continuous service for a period of one year if he has, for that period, been in uninterrupted service –

Permitted Interruptions:

Including the service which may be interrupted on account of –

- Sickness,

- Accident,

- Leave,

- Absence from duty without leave (without break in service)

- Lay off,

- Strike or Lock Out or Cessation (stopping) of work not due to any fault of the employee.

Exclusion from Period of Service

The period of service not to be included –

- Absence treated as ‘break in service’ in accordance with rules or regulations governing the employees.

- Strike or lock out or cessation of work due to any fault of the employee.

One Year’s Service –

Section 2A Clause (2) –

- where an employee is not in continuous service within the meaning of clause (1) i.e. there is a break in service, he shall be deemed to be in continuous service :

(a) For the period of 1 year –

- if he as actually worked for not less than 190 days in the case of an employee employed below the ground in a mine or in an establishment which works for less than 6 days in a week, and

- 240 days, in any other case;

Six Months Continuous Service

(b) for the said period of 6 months :

If he has actually worked for not less than 95 days in the case of an employee employed below the ground in a mine or in an establishment which works for less than 6 days in a week, and

120 days, in any other case.

Period to be included –

For the purpose of Clause (2), it shall include the days of –

- Permitted lay-off

- Leave with full wages

- Absent due to temporary disablement caused by accident arising out of and in the course of his employment; and

- In the case of a female, maternity leave not exceeding 12 weeks.

Service of a Seasonal Employee

Section 2A (3):

- An employee, employed in a seasonal establishment, shall be deemed to be in continuous service for a season, If he has actually worked for not less than 75% of the number of days on which the establishment was in operation.

Wages for Payment of Gratuity

For payment of gratuity, Wages (salary) to be taken:

- For regular & seasonal employees, last drawn wages [Sec 4 (2)]

- For piece rated employees, average of wages drawn by the employee during his last 3 months of service immediately preceding the termination of his employment (i.e. starting from the date of retirement). [Sec 4 (2) Proviso 1]

Rate of Payment of Gratuity

- Employees are entitled to 15 days’ terminal wages as gratuity for each year of completed service or part thereof in excess of 6 months. [Sec 4 (2)]

- Seasonal employees are entitled to 7 days’ terminal salary for each season of service. [Sec 4 (2) Proviso 2]

(iii) In case of monthly rated employees, monthly wages is to divided by 26 to calculate one day’s wages. [Sec 4 (2)]

(iv) Maximum gratuity payable as per the Act is Rs.20,00,000. [Sec 4 (3)]

Meaning of ‘Salary’

Salary = Last drawn Basic Salary + Dearness allowance + Commission based on fixed percentage of turnover.

Note: As per act it is last drawn salary + DA but as per Supreme Court Ruling we take Commission based of fixed percentage of turnover or Retaining Allowance. Overtime wages are not taken.

Gratuity Calculation Formula for Monthly Rated Employees

15/26 x Last Drawn Wages x No. of completed years of service or in part thereof exceeding 6 months

Gratuity Calculation Formula for Piece Rated or Temporary Employees

15/26 x Average of last 3 Months x Completed years of Service or in part thereof exceeding 6 months

* Last 3 months wages immediately proceeding from the retirement date.

Gratuity Calculation Formula for Seasonal Employees

7/26 x Terminal Wages x Completed no. of Seasons

Can an employer pay higher amount of gratuity?

Yes.

Section 4 (5) provides that –

Nothing in this section (i.e. Section 4) shall affect the right of an employee to receive better terms of gratuity under any award or agreement or contract with the employer.

Time Limit for Payment

Section 7 (3) –

The employer shall pay the amount of gratuity within 30 days.

Section 7 (3A) –

If not paid within 30 days, then it has to be paid with simple interest, not exceeding the rate notified by the Central Govt. from time to time for repayment of long term deposits.

Forfeiture of Gratuity Benefits

Section 4 (6)(a) :

The gratuity of an employee, whose services have been terminated for any act, willful omission or negligence causing any damage or loss to, or destruction of, property belonging to the employer, shall be bto the extent of the damage or loss so caused;

Section 4 (6) (b):

- The gratuity payable to an employee may be wholly or partially be forfeited if the services are terminated –

- For his disorderly conduct or any act of violence

- An offence involving moral turpitude in the course of his employment.

Nomination in Gratuity

Section 6:

- This facility of nomination is made available to an employee who has completed one year of service.

- It provides for multiple nominations and proportions of the Gratuity to be earmarked for each of the nominees.

- An employee can make the nomination only in favor of members of his family if he has a family.

- Any nomination made in favor of a person who is not a member of the family is void.

- In case of no family then nomination can be made in favor of a stranger.

- If nominee predeceases the employee then his interest shall revert to the Employee.

Compulsory Insurance

- As per Section 4 A :

- Every employer should obtain insurance for his gratuity liability under this Act, from LIC or a Life Insurance company.

- But this provision of Compulsory Insurance would be effective only from the date of its notification by the Government. The Govt. has not so far notified it.

- So, compulsory insurance provisions are not yet applicable.

Tax treatment of Gratuity

A. Government employees u/s 10(10)(i)

In the case of such employees, the entire amount of death-cum-retirement gratuity received is exempt from tax under section 10(10)(i). Nothing will, therefore be taxable as the case may be on account of gratuity.

B. Non-government employees covered under ‘The Payment of Gratuity Act, 1972’ u/s 10(10)(ii):

The minimum of the following amounts is exempted from tax:

- Actual Amount of Gratuity received.

- 15 DAY’S salary ( calculated as 26 working days in a month) based on last drawn salary for every completed year or part thereof exceeding six months,

- Rs. 20,00,000/-,

- For seasonal employee instead of 15 days it will be 7 days salary.

- For piece rated employee 15 DAY’S salary will be calculated as 26 working days in a month and computed on the average of the total wages received by him for a period of 3 months immediately preceding the termination of employment and the wage paid for any over time work shall not be included.

C. In case of other employees, u/s 10(10)(iii) (not covered under Payment of Gratuity Act

The minimum of the following amount is exempted:

- ½ x Average wages of last 10 months x Completed years

- Rs. 20,00,000/-,

- Actual gratuity received.

Average wages to be counted from month preceding the month in which the event occurs.

Gratuity received by the legal heirs after the death of the employee

| Normal date of retirement | When gratuity becomes due | Payment date of gratuity | Date of Death | |

| Situation 1 | June 30, 2007 | June 30, 2007 | July 11, 2007 | July 6, 2007 |

| Situation 2 | June 30, 2013 | July 6, 2007 | July 11, 2007 | July 6, 2007 |

Situation 1:

If the gratuity becomes due before the date of death of the employee, but is paid after the date of death:

- After claiming exemption u/s 10(10)(ii)/(iii), the balance shall be included in the salary of the employee. Income tax return shall be submitted by legal heirs.

Situation 2

If the gratuity is sanctioned and paid after the death:

- It cannot be taxed in the hands of deceased employee as it becomes due and is paid after his death.

- This amount is also not taxable in the hands of legal heirs as it does not partake the character of income in their hands but is only a part of the estate devolving upon them.

Funding of Gratuity Liability

- Options for employers

- Advantages of funding of liability

- Gratuity is a statutory benefit for the employees, hence a statutory liability of the employer to pay

- Most of the employers pay gratuity to the eligible employees on “Pay As You Go” basis.

- They are either reluctant or ill advised not to make any arrangement for this “Statutory” liability.

- As per Accounting Standards, it has, now, been made mandatory to at least show book “Provision” of this liability in the Annual Accounts of the company.

- For this book provision, an employer has to approach an Actuary every year for calculation of the liability amount.

- This “book provision” does not give any “Tax” or “Other” benefits to the employer.

Benefit for Employers

Contributions to Approved Gratuity Fund up to 8.33% of the annual salary per employee are allowed as expenses (salary means basic plus dearness allowance)

Options

- “Pay as you go” method: The amount of liability is not provided for in a separate fund.

- Gratuity is paid to the employees on exit, out of current revenue.

- “Funding” method: The liability is scientifically got evaluated from an actuary and then physically paid into a “Gratuity Fund”.

Benefits of Funding of the Liability

This method of “Funding the Liability” does have many benefits.

- The contributions by the employer are allowed as deductible expenditure. Thus, the employer saves Income Tax on the full amount.

- The interest income of the Approved Gratuity Fund is not taxable u/s 10 (25) (iv). Hence, yield becomes more attractive.

- The tax-free interest income reduces the effective cost of funding in future.

- The employer’s cash out-go is not affected on exit of his employees because the payment is made from the fund.

- An employer not funding the gratuity liability shows inflated profits and consequently pays higher taxes.

Learn more about financial planning. It will help you to manage and plan your financial goals.